Washington’s organic blueberries growing more profitable

From 2009 to 2012, organic blueberry acreage in Washington state increased by 130 percent, while production tripled. In the same period, the farm-gate value of the state’s organic blueberries rose from $7 million to $23 million. Washington is now the leading producer of organic blueberries in the United States, according to a fact sheet recently published by Washington State University.

“Trends and Economics of Washington State Organic Blueberry Production” was published to help growers decide if they should enter the organic blueberry market, or expand their current organic production.

When making those decisions, there are some broad factors to consider: Average yields for the state’s organic berries are lower than those for all blueberries (partially due to the high proportion of young plantings), but average market prices are higher. And in the next few years, a large increase in the supply of conventional and organic blueberries is expected, which could lead to a supply-demand imbalance that might depress prices in the future, according to the fact sheet.

Growth

According to the Organic Trade Association, organic food sales grew 11.5 percent in 2013, with fruits and vegetables accounting for one-third of all sales. The growth in blueberries might be even more impressive. According to the North American Blueberry Council (NABC), world highbush blueberry acreage grew by 42 percent from 2008 to 2012, while production grew by almost 70 percent, according to the fact sheet.

The Pacific Northwest has become the world’s largest blueberry region, producing 261 million pounds in 2012 (one-fourth of the world’s total highbush volume). British Columbia was the largest producer, with 115 million pounds. Washington reached 11,360 acres and 70 million pounds in 2012, ranking the state third in U.S. production behind Michigan and Georgia, according to the fact sheet.

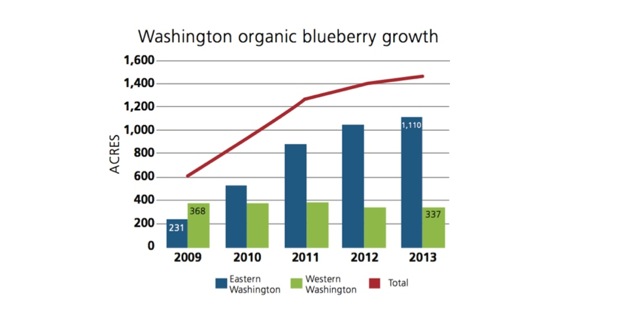

The state’s certified organic blueberry acreage increased from 599 in 2009 to nearly 1,400 in 2012. Organic acreage continued to grow in 2013, with 1,626 acres certified and nearly 200 in transition. These numbers likely underestimate potential acreage, because growers often postpone applying for certification or transition until the crop is close or starting to bear. The Washington Blueberry Commission estimated that 75 percent of the 2013 organic blueberry acreage was not yet bearing and that more was being planted, according to the fact sheet.

Future

NABC predicts that worldwide highbush acreage will grow 41 percent from 2012 to 2017. It’s not certain how the market will handle that increased supply and how it will affect organic prices. The rapid growth has sometimes been accompanied by subpar yields, and planting is slowing in some of the most productive regions, so supply may not increase as rapidly as acreage. It’s also possible that demand for organic blueberries will grow faster than demand for conventional, according to the fact sheet.

With 70 percent price premiums and only 10-15 percent greater production costs than conventional, organic blueberries can certainly be a profitable choice for growers. There might be more consistent profits for growers on the west side of the state, however, where Washington’s blueberry industry initially developed. Even though most of the growth in organic blueberries is now occurring in the irrigated regions east of the Cascade Range – where growers can achieve organic yields at conventional levels for many varieties (a tougher feat for west-side growers to achieve) – east-side growers are more vulnerable to large price drops in commodity markets, whereas many west-side organic growers sell direct and are better insulated from those price swings, according to the fact sheet.

09/15/2015

Source: Fruit Growers News