Agronometrics in Charts: Opportunities for organic blueberries in the U.S. market

Written by Colin Fain of Agronometrics for the North American Blueberry Council (NABC). Original published on www.nabcblues.org.

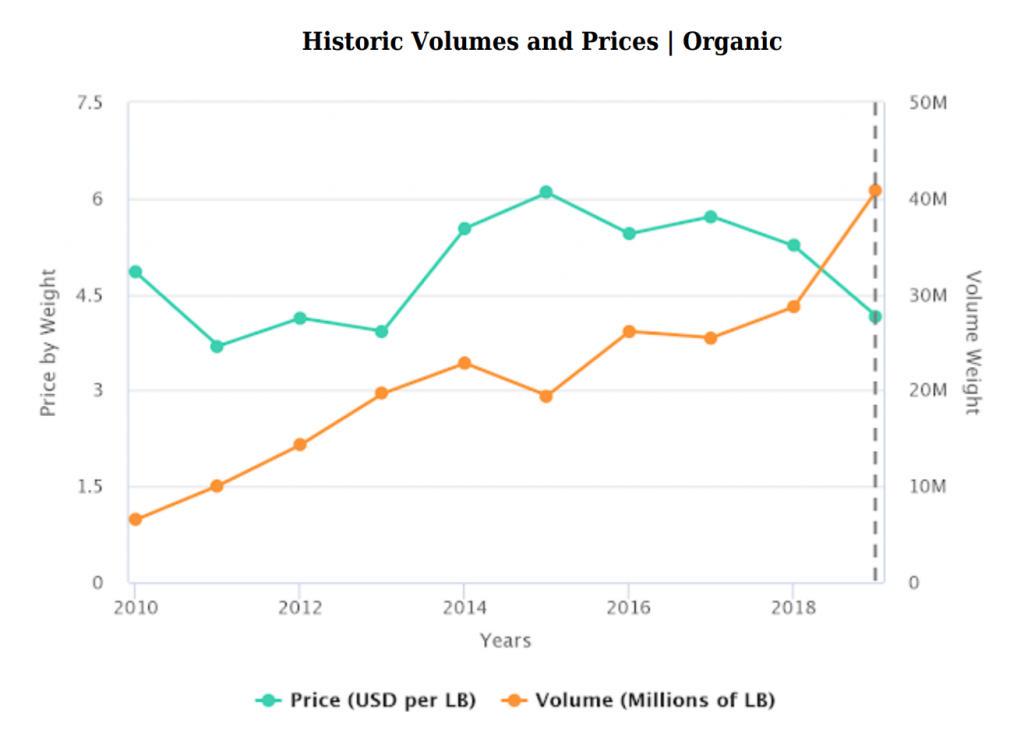

In the last 10 years, organic blueberries as a category have seen an incredible level of growth. As measured by the USDA, it has increased by more than six-fold, all while maintaining relatively stable pricing. There is undoubtedly a growing hunger for organic blueberries that the market is successfully satisfying.

(Source: USDA Market News via Agronometrics. Agronometrics users can view this chart with live updates here)

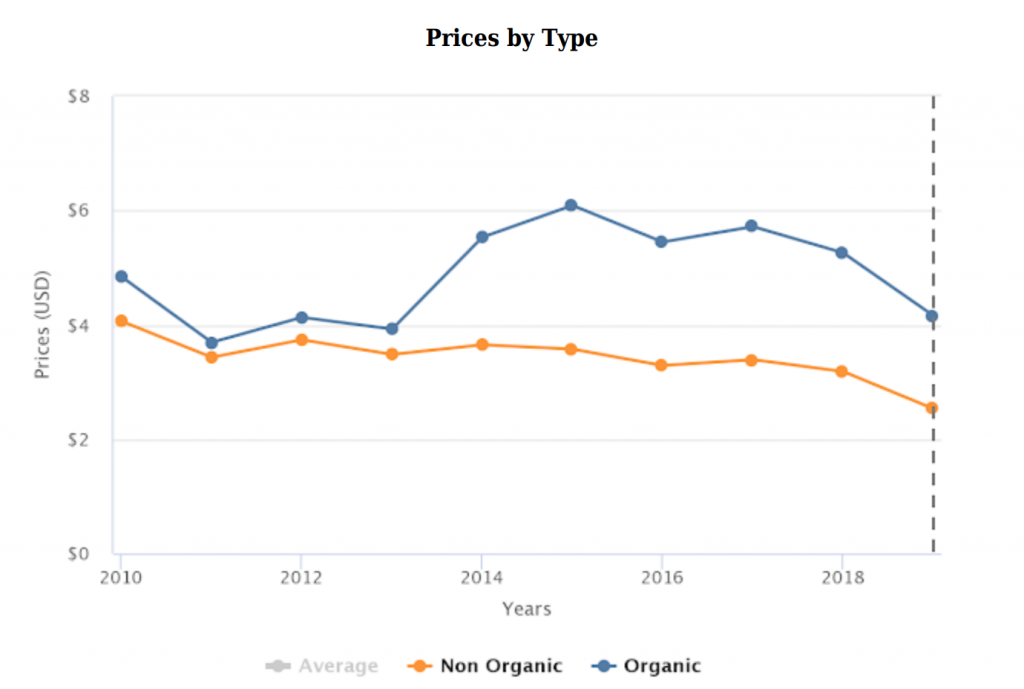

For producers, organic fruit premiums have been a strong incentive to get into this segment of the category. From 2014 to 2019, where USDA’s records are more complete, the average difference between the two categories is $2.09 USD/LB.

(Source: USDA Market News via Agronometrics)

The chart and the numbers presented above, however, are an average of the entire year. With a highly seasonal product like blueberries, heavy fluctuations in price throughout the year are the norm.

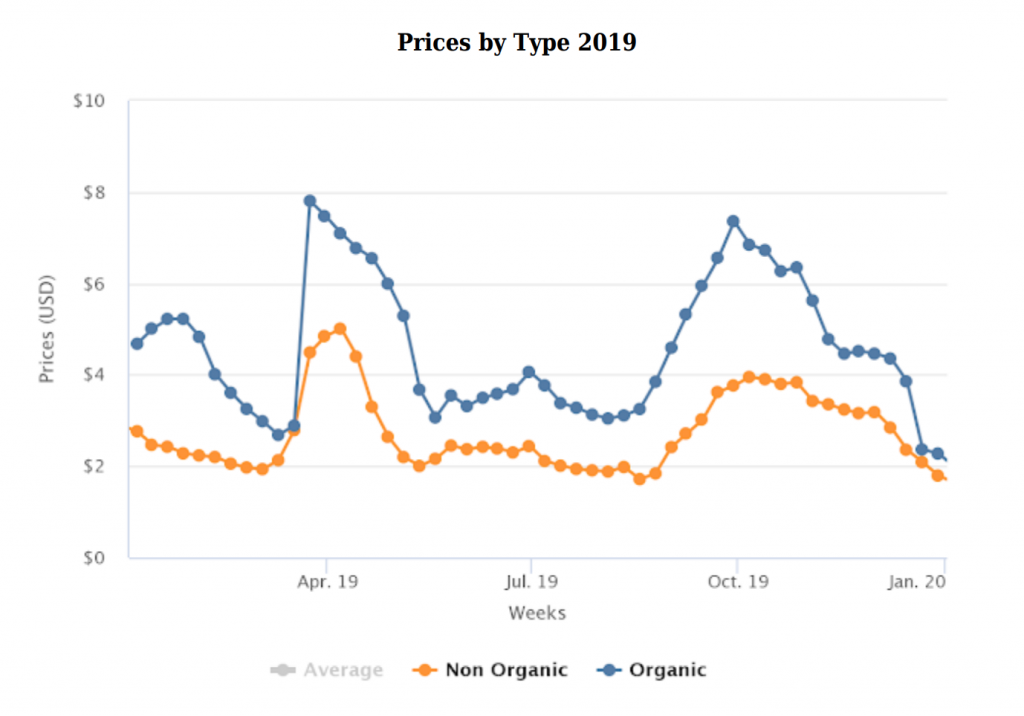

Looking back on 2019 we can see that the premium varies greatly throughout the year, ranging from $0.10 USD/LB to $3.59 USD/LB, sometimes with only one week between the smaller and larger premiums.

(Source: USDA Market News via Agronometrics)

The seasonal variation in pricing also means that different origins receive different premiums. What may be a great opportunity for one producer may offer smaller returns for growers operating in a different region and selling their fruit at a different point in the year.

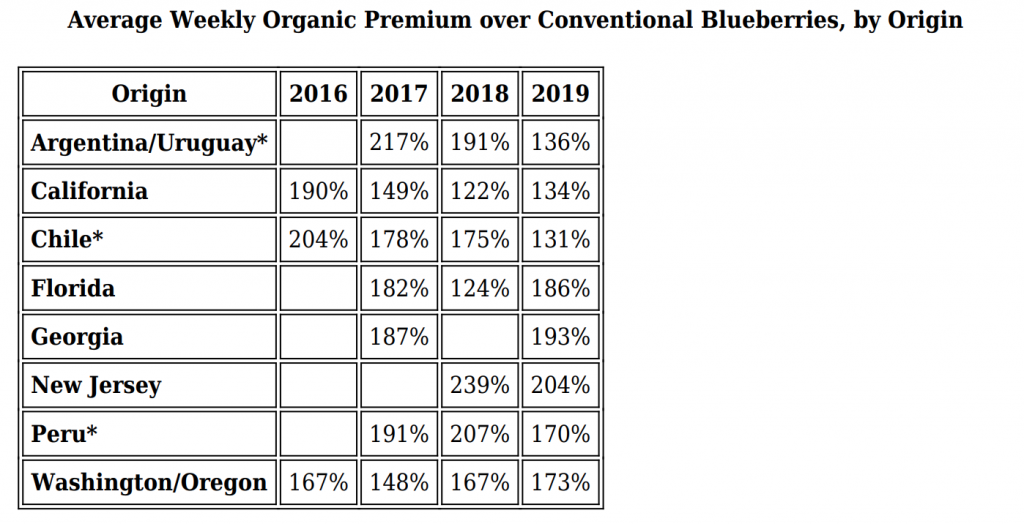

By comparing the percentage difference between the weekly organic and conventional prices weighed by the volume of organic fruit (where available), the table below offers an average premium for each growing region over the last four years.

There are many insights to be gained from this interpretation of market data. An individual study of each origin is possible, but that gets away from the intent of this report, which is meant to summarize the category as a whole.

That said, Washington and Oregon stand out as an origin that has seen consistent growth for the category over the last three years. New Jersey and Georgia also stand out for the high premiums they receive from organic fruit over conventional during their seasons.

One of the biggest takeaways from this table is that increasing volumes of organic blueberries relative to conventional are putting downward pressure on premiums. We can see the effects of this in most origins where the percentage premium is steadily decreasing year after year.

Although some premiums show an increase in 2019 compared to 2018, it is important to keep in mind that these figures are calculated in relation to conventional fruit, which has seen a general decrease in recent years that has been also echoed in organics.

Conclusions

The historical growth of the organic blueberry segment is undeniable and the category’s relative stability in prices is impressive. New volume opportunities exist for organic blueberries in the U.S. retail, foodservice and ingredient markets, and in export channels, but as the market matures, extracting this growth will require new tools and skills.

Agriculture is a continually evolving, complex and risky game of balancing production costs with retailer and consumer demand, and price-point sensitivities. As with other specialty crops, growers of conventional and organic blueberries are currently struggling with the realities of increased input costs and ever-tighter margins in a competitive global landscape.

Understanding available production windows and the timing of harvests play a critical role in earning sufficient premiums for any type or variety of fruit. This is particularly true for organic crops which can have higher production costs.

As the complexity of global market production and demand variables increases, it becomes more difficult to effectively manage production levels and distribution logistics on conventional and organic specialty crops. Effectively growing to meet retail and foodservice channel demands – at a fair and profitable price point – will require smart business planning that is informed by accurate market data.

In a mature market, increased access to, and utilization of datasets that provide a more integrated and comprehensive view to the entire value chain is a powerful and effective way to manage the complexity of a global specialty crop that serves multiple channels – grocery retail, foodservice, manufacturing and export.

There is still considerable volume and dollar growth to be mined from domestic and global, conventional and organic blueberry markets. However, growers and their partners will struggle to effectively extract this next era of growth without access to the right data and application of the right analytics that provides the necessary insights into the marketplace dynamics affecting production, pricing and demand.

09/06/2020