Agronometrics in Charts: Peru takes the crown as the leading exporter of blueberries yet again

In this installment of the ‘Agronometrics In Charts’ series, Sarah Ilyas studies the state of the Peruvian blueberry industry. Each week the series looks at a different horticultural commodity, focusing on a specific origin or topic visualizing the market factors that are driving change.

According to the Asociación de Productores de Arandanos del Perú (Peruvian Blueberry Exporters Association), 276,938 tons of blueberries are projected to be shipped from Peru in the 2022-2023 season. In this season’s campaign that ran from May to October, the country shipped 153,228,933 kilos of fresh blueberries for 843,725,006 dollars, i.e. 31% more volume than in the same period of the previous campaign 2021/2022, says Cilloniz Benavides, president of Inform@cción.

According to the USDA Seasonal Perishable Products Weekly Report the season is already past its peak and imports through Philadelphia, New York City and Southern California ports of entry are expected to dwindle as growers begin to wind up the season. During the 2021-22 campaign, La Libertad had a representation of 54.11%, followed by Lambayeque with a representation of 21.16% and Lima with 7.98% of the total.

Source: USDA Market News via Agronometrics. (Agronometrics users can view this chart with live updates here)

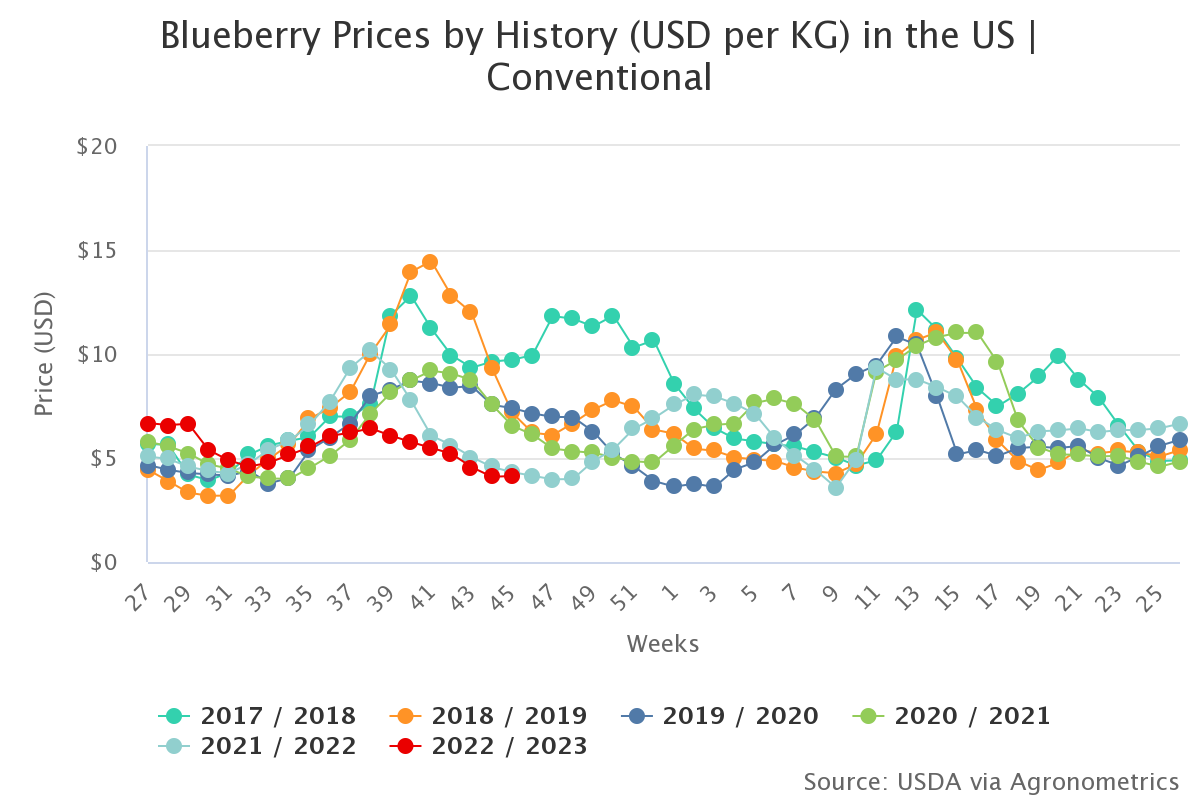

Blueberry prices have been slipping year after year due to the copious supply coming in from Peru and other countries. These volumes have led to imbalances in the supply/demand market. In October, prices fell below 5 dollars per kilogram. The US dollar has been losing value against the Peruvian nuevo sol and producers are likely to be impacted more severely by the dip in prices now, in comparison to previous years.

Source: USDA Market News via Agronometrics.(Agronometrics users can view this chart with live updates here)

Source: USDA Market News via Agronometrics.(Agronometrics users can view this chart with live updates here)

Source: USDA Market News via Agronometrics.(Agronometrics users can view this chart with live updates here)

Source: USDA Market News via Agronometrics.(Agronometrics users can view this chart with live updates here)

According to Proarándanos, the blueberry industry today is beset with several challenges, such as exorbitant maritime freight costs, with increases of more than 70% compared to pre-pandemic levels, lack of containers and the closure of destination ports. Despite these limitations, Peru has managed to maintain its position as the world’s leading exporter of blueberries this season, for the fourth consecutive year owing to the above par performance of its shipments, according to the Association of Peruvian Exporters (Adex).

“Worldwide, Peru has been ranked first as an exporting country since 2019, a position that has been maintained in 2020 and 2021,” says Adex Consulting and Projects Head, Lizbeth Pumasunco. The country has also been successful in reaching new markets (Portugal, Israel and Jordan) in the 2022 campaign.

In our ‘In Charts’ series, we work to tell some of the stories that are moving the industry. Feel free to take a look at the other articles by clicking here.

All pricing for domestic US produce represents the spot market at Shipping Point (i.e. packing house/climate controlled warehouse, etc.). For imported fruit, the pricing data represents the spot market at Port of Entry.

You can keep track of the markets daily through Agronometrics, a data visualization tool built to help the industry make sense of the huge amounts of data that professionals need to access to make informed decisions. If you found the information and the charts from this article useful, feel free to visit us at www.agronometrics.com where you can easily access these same graphs, or explore the other 21 commodities we currently track.

17/11/2022