A look at Serbia’s 2023 blueberry season

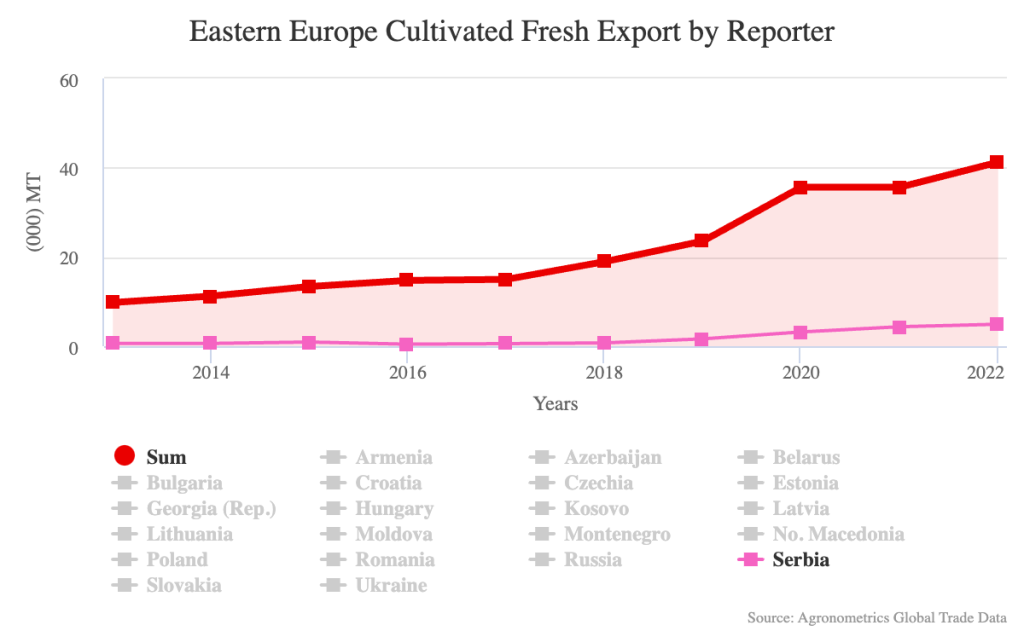

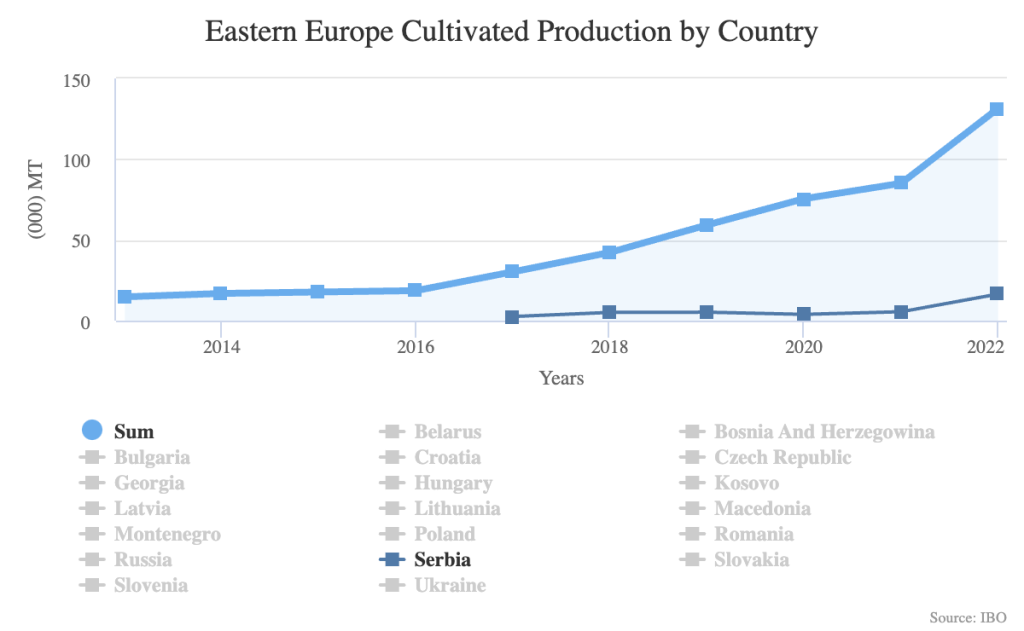

Serbia is a major producer of blueberries in Europe, with a season that runs from early June to October and an annual output of around 7,000 metric tons. The country’s blueberry industry has 23 export markets, including the Netherlands, Russia, Germany, Poland, and Great Britain.

Serbia’s blueberry industry faced a challenging 2023 season, primarily due to significant quality issues. Despite these challenges, the production volume remained consistent with previous years, totaling around 6,500 tons. This figure aligns with the country’s historical output, indicating stability in terms of quantity. However, the quality of the fruit was notably problematic, impacting both exporters and the market.

The 2023 season saw an unprecedented level of fruit rejection due to quality concerns. Typically, exporters from Serbia maintain a rejection rate between 2% and 4%. However, last year, this rate spiked to 14%, with other producers experiencing rejection rates as high as 30%. This fivefold increase in fruit rejection was attributed primarily to adverse weather conditions, particularly a very rainy May that occurred just before the harvest period from weeks 23 to 28. The excessive rainfall likely contributed to the fruit’s softness and other quality defects.

Serbia’s blueberry industry also grapples with rising labor costs, driven by the improving economic situation in the country. As local workers seek higher-paying opportunities abroad, Serbia has seen an influx of laborers from other countries to meet agricultural demands. The daily labor cost in Serbia ranges from 35 to 40 euros, significantly higher than in countries like Morocco, where labor costs are around 12 euros per day. Additionally, growers face increasing costs for fuel, fertilizers, and other essential inputs, without corresponding increases in blueberry prices, further squeezing profit margins.

“The predominant blueberry variety grown in Serbia is the Duke, accounting for 90% to 95% of production. There is limited experimentation with other varieties such as Draper and some new varieties, though these trials cover less than 10 hectares. The industry is slowly recognizing the need to adapt to fast-changing market demands and newer, potentially superior varieties,” says Dejan Djusic, general manager at First Blueberry Doo.

Serbia’s geography and climate offer specific advantages for blueberry production. The early harvest period in June allows Serbian blueberries to meet market demand in Europe before the major influx of produce from countries like Poland in July, which helps fetch better prices early in the season. Additionally, Serbia benefits from abundant water resources. Landowners can drill wells and use groundwater for irrigation without incurring costs, unlike in many other European countries where water use is tightly regulated and often expensive.

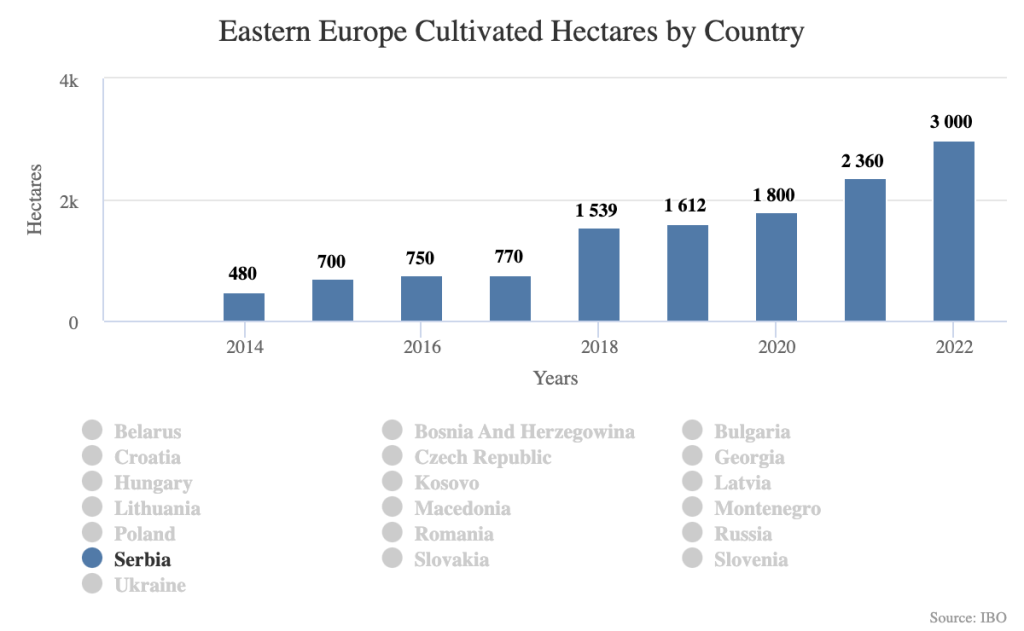

Blueberry production in Serbia is dispersed across various regions, with significant cultivation around the town of Šabac. Government support for agriculture, including blueberry production, is available through national and European Union funds. National subsidies cover up to 50% of certain agricultural investments. EU funds, combined with national contributions, can subsidize projects by 50% to 75%, for project values reaching up to 1.5 million euros.

Despite the hurdles faced during the 2023 blueberry season, Serbia’s industry has demonstrated resilience and potential for growth. The stability in production volumes amidst quality challenges underscores the industry’s ability to adapt to adverse conditions. As Serbia continues to navigate economic and labor pressures while exploring varietal diversification, the country’s geographic advantages and government support schemes offer a promising foundation for future success. With ongoing efforts to address quality issues, capitalize on geographic advantages, and leverage government support, Serbia’s blueberry industry is poised to overcome challenges and thrive in the global market.

31.05.24

Source: Agronometrics